FLEXPAY FOR EMPLOYERS

Earned wage access (EWA) is a financial service offered by Librent Investments Inc. through its product Flexpay. This service enables employees of partner organizations (employers) to access their earned wages any time before their payday.

There are no monthly fees for employees and it is absolutely FREE for employers.

Flexpay offers major benefits to employers:

Financial wellness for all employee results in:

- A focused workforce

- Satisfied employees

- Increased employee engagement

- Improved workplace morale

- Enhanced staff retention

- Attraction for new employees

All this with NO INVESTMENT on the part of the employer

Flexpay is a great service for employers.

An organization with happy and satisfied employees is one that can really thrive. The service is very simple. It allows employees to access their earned wages any time they like. This helps employees manage their cash flow and better navigate any financial emergency with no financial stress.

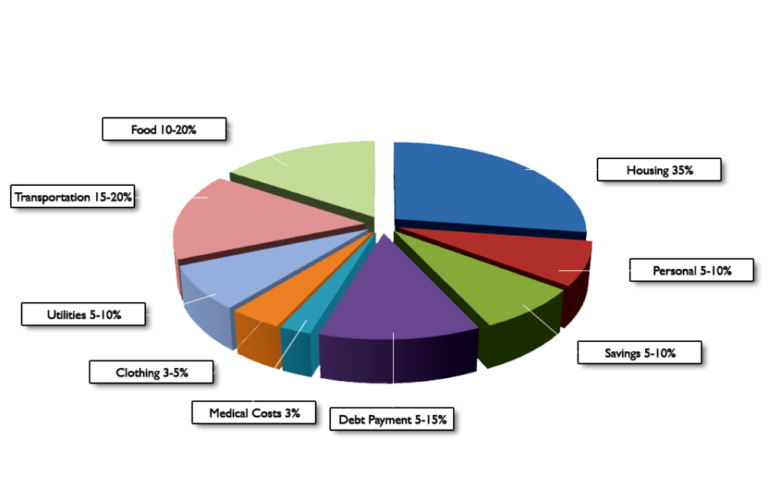

According to a 2021 survey by the World Bank, 85.66% of workers in Canada are wage and salaried workers. As illustrated below, an estimated 85% of Canadian household income goes to fixed monthly expenses like housing, food, transportation, and utilities, according to the Canadian Counselling Society. That leaves 15% for educational, personal, and other expenses, including financial emergencies. This is a very small percentage to survive on for the month, especially when these individuals often have families depending on them financially.

Flexpay makes it easy to plan, budget, spend what is necessary and save to live today with dignity, while building a secure financial future and offering peace of mind to all employees.

A recent report compiled by Equifax Canada shows that the average individual consumer’s debt is $21,128, excluding mortgage. This means that for couples and families, average consumer debt is closer to $42,250. Any unexpected expenses, like car repairs, higher-than-usual utility bills, etc., can cause financial difficulty. A report on payday loan market trends by the Government of Canada shows that households with low to moderate income (under $55,000) and many higher income households (exceeding $80,000) access these exorbitantly high-interest payday loans.

Consequently, in case of a financial emergency, these salaried individuals, especially those with moderate incomes, have little to no savings or investments they can lean on. These employees show up to work and earn their wage every day but only have access to their bi-weekly income with a week’s delay, when payroll is processed.

Contact Us

Please share your details below and we’ll get in touch with you.